capital allowance rate lhdn

10 This Note is issued to. You can deduct some or all.

Should Influencers Gig Workers And Those In The Digital Economy Pay Income Tax To Lhdn Iproperty Com My

Work out your capital allowances at the main rate 18 or the special rate 6.

. Standard rates With effect from YA 2000 cyb capital allowances will be re-categorised into three classes and the rates of. Reinvestment Allowance Part I - Manufacturing Activity Example 47 is updated by. The income tax rate for resident individuals is reduced from 14 to 13 on taxable income in the range of RM50001 to RM70000 for the Year of Assessment ending 31.

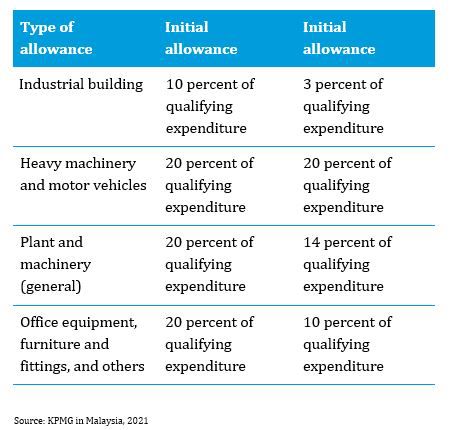

Last reviewed - 13 June 2022 Capital allowance Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of. Conditions to claim capital allowances at the normal rate under Schedule 3 of the ITA. These are known as plant and machinery.

Annual allowance rates depend on the types of assets. 52014 titled Ownership And Use Of Asset For The. A Effective from YA 2020 taxpayers are eligible for a special capital allowance claim of 100 on assets valued at RM2000 previously RM1300 or less per asset.

The owner of the said asset. This is subject to a. Reinvestment Allowance Part II - Agricultural And Integrated Activities.

The annual allowance is distributed each year until the capital expenditure has been fully written off. Capital allowance elaun modal is only given to business activity and only to the person who has expended on the purchase or acquisition ie. However depending on the type of allowance some LHDN tax deductions are applicable and you can meet both top-management and employees expectations.

CLAIMING CAPITAL ALLOWANCE ON THE DEVELOPMENT COST FOR CUSTOMISED COMPUTER SOFTWARE UNDER THE INCOME TAX RULES 2019. The notable differences between the 2018 and 2014 Rules are as follows. Special Rates Of Allowances Special rates of allowances provided under Schedule 3 of ITA 1967 and Income Tax Rules may be categorized to accelerated capital allowance accelerated or.

Company with paid up capital less than RM25 m oFirst RM600000 oIn Access of RM 500000 17 24 Company with paid up capital more than RM25 m 24 UPDATED 06062021 The. The ACA provided under the Income Tax Accelerated Capital Allowance Excursion Bus Rules 2021 can be claimed within a period of 2 years with an initial allowance. The Government has initially introduced special tax deduction on cost of renovation incurred from 1 March to 31 December 2020 in the first economic stimulus package announced.

CURRENT CAPITAL ALLOWANCES RATES FOR PLANT A1. 2014 Rules 2018 Rules Effective period YA 2014 to YA 2016 From YA 2017 Capital Allowance rates Initial. The rates are as follow.

A the amount of the capital expenditure incurred on the construction of the building reduced by the aggregate amount of all annual allowances which if the building from the time of its. For more information please refer to the PR No. If you use an item outside your business and youre a sole trader or partner put it in a separate pool.

In this article Seekers will. Automation capital allowances for the manufacturing sector Income tax exemption. You can claim capital allowances when you buy assets that you keep to use in your business for example.

The total capital allowances of such assets are capped at RM20000 except for SMEs as defined. To legislate the proposals the Income Tax Accelerated Capital Allowance Machinery and Equipment including Information and Communication Technology Equipment. Capital expenditure for the installment payments 95300 Hire purchase interest RM9600 48 RM200 per month Monthly installment RM95300 48 RM1985 for 47 installments.

33 Computation of capital allowances for ya 2000 CY subsequent YA 331 New assets The amount of AA is a percentage of the QE incurred on the asset calculated according to the.

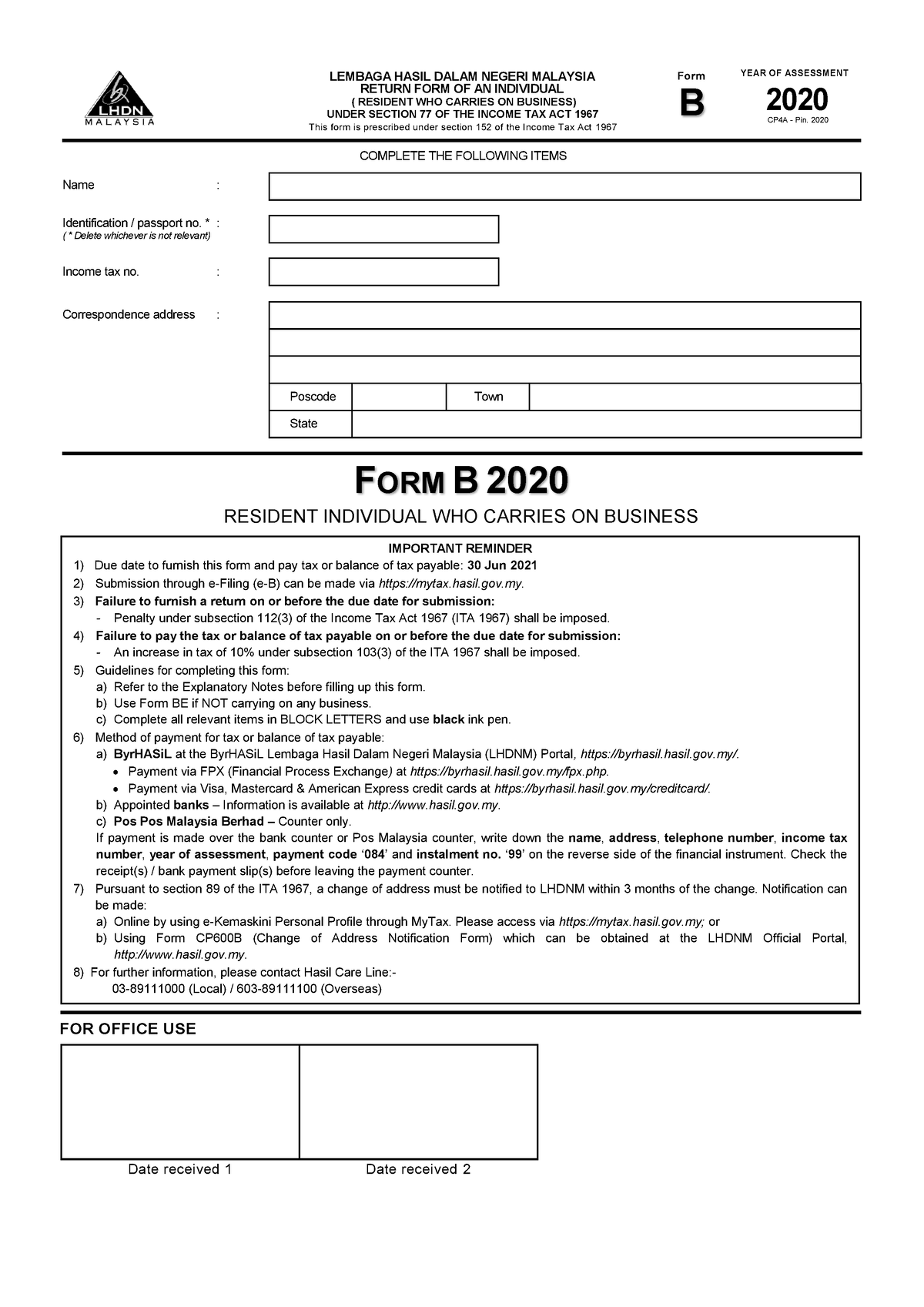

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Malaysia Personal Income Tax Guide 2020 Ya 2019

Lhdn St Partners Plt Chartered Accountants Malaysia Facebook

Preparing The Capital Allowance Computation Non Pool Assets Acca Taxation Tx Uk Youtube

Financial Reporting 4 Flashcards Quizlet

Tax Incentives For Research And Development In Malaysia Acca Global

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

Malaysia Taxation Junior Diary Capital Allowance Schedulers

What Is An Investment Holding Company And When Is It Useful

Lee Lim Tax Incentives For Relocating Company From Facebook

Bridgeknowle Year End Checklist For Hr Companion Workbook

Malaysia Taxation Of Cross Border M A Kpmg Global

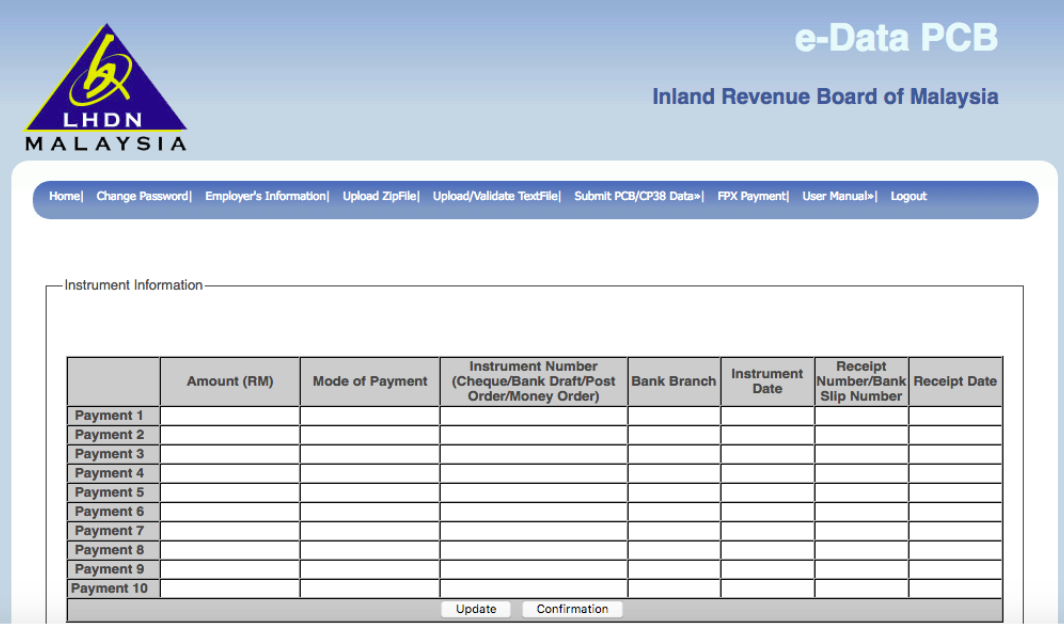

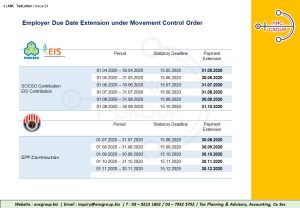

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Covid 19 Tax Related Measures

Highlights Of Malaysia S 35 Billion Short Term Economic Recovery Plan

Bridgeknowle Year End Checklist For Hr Companion Workbook

0 Response to "capital allowance rate lhdn"

Post a Comment